After they complete our small business management course or MYOB training course many of our students go on to start their own home-based bookkeeping business. Among the many things you learn in our small business management course is how to effectively market a small business.

Why Market?

For any new business, it’s important to market your new business so develop new leads and customers, but it’s also important that your marketing costs don’t outweigh your income. In the marketing module of our small business management course, we talk about Google Adwords, which is a low-cost way to advertise your business online, using keywords.

Another Option is Facebook

Facebook is also another option for businesses large and small, but we think it works particularly well for small businesses, due to the community-minded nature of Facebook, itself.

There’s an old saying around EzyLearn: People like to do business with people they know, like and trust. Facebook helps you to develop online relationships with your customers, allowing them to get to know, like and trust you.

But in case you’re still not convinced, here are another 6 reasons why you should be on Facebook:

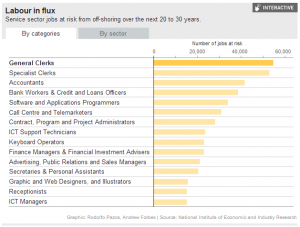

- Population and penetration: We know that over 1 billion people are on Facebook, but what’s the penetration rate for a market, like the USA, for example? 67 percent of internet users in the US are on Facebook; in Australia that penetration rate is much higher—82 percent.

- Age: Facebook skews young—83 percent of 18-29 year olds are on Facebook—but the 45-54 age-bracket has also seen 46 percent growth since the end of 2012.

- Income: The incomes of Facebook users higher than any other social media platform. 73 percent of Facebook users earn more than AUD$75,000 compared to 17 percent for Twitter.

- Mobile: Social media is the most popular social media app on smartphones and accounts for 66 percent of total social media sharing on iphones.

- Gender: Like every other adverting medium, Facebook also skews toward women, but it’s still more gender neutral than Google+ or Pinterest.

- Education: Nearly 75 percent of Australian Facebook users have some form of university or tertiary education.

If you’re looking to target any or all of these demographics for your small business marketing campaign, then create a Facebook page and start marketing your services to your followers.