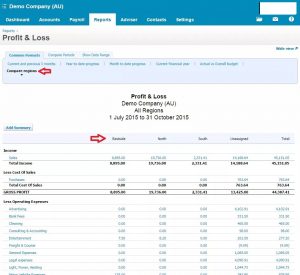

Learn How to Run a P&L Using Xero

A basic, yet vitally important, report for every business owner is a profit and loss (P&L) statement. A profit and loss statement, as the name suggests, shows whether a business is running at a profit or a loss over a given period. We’ve written about why running multi-period P&Ls before in QuickBooks and MYOB is a good idea for businesses with inventory, but single period P&Ls are equally important for all businesses.

If you’re a bookkeeping newbie, a profit and loss statement, which sometimes goes by other names — income statements, earning statements, revenue statements, operating statements, statement of operations, or statement of financial performance — is a basic report you’ll learn to run in our Xero Daily Reconciliations Course. If you’re planning to work as a contract bookkeeper, you should get in the habit of running P&L statements for your clients regularly (if you’re a business owner, ask your bookkeeper to run them).

P&Ls are required by law

Depending on how a business is structured, it may be required by law to complete a P&L. A P&L shows how the revenue of the business is turned into net income by subtracting all expenses from income. They’re also useful for understanding a business’ net income, which helps with the decision making processes. A business will also need a P&L if they’re applying for a small business loan.

The contents of a P&L

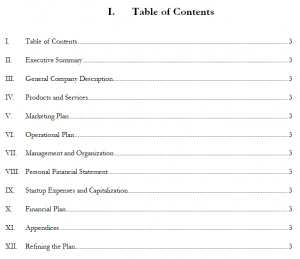

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.

***

Because P&L statements are often used by a business’ owner to make financial decisions, to inform shareholders of the business’ performance, apply for a business loan, or as proof of income in the sale of a business, it’s important that you understand how to create one correctly. Our Xero Daily Reconciliations Training Course covers P&L statements, and much more. Visit our website to learn more or to enrol.

***

Did you know that EzyLearn Excel, MYOB and Xero online training courses count towards Continuing Professional Development (CPD) for bookkeepers and accountants?We’ve been an accredited training provider of the Institute of Certified Bookkeepers ever since the organisation started in Australia. Find out how CPD points can be of benefit to you.

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our

IN ADDITION TO OUR

IN ADDITION TO OUR

I once wrote a

I once wrote a