Creating training materials for cloud-based accounting software is a continuous process of improvement. In fact it is much like the process that the software goes through in their Continuous Innovation & Continuous Delivery process.

Two of Australia’s newest billionaires Mike Cannon-Brookes and Scott Farquhar have become wealthy because they created software that enables companies like MYOB manage a team of developers, designers and analysts in the pursuit of continuously adding enhancements, updating the software, fixing bugs and providing support for their MYOB Tax software via their company Atlassian, but I digress.

The reason for this post is because of obscure behaviour by MYOB regarding their essentials software and a recent upgrade they performed on the MYOB Essentials software.

Continue reading APOLOGIES to students on behalf of MYOB Essentials Accounting Software. Attn: MASSIVE update coming for MYOB Essentials Course Materials

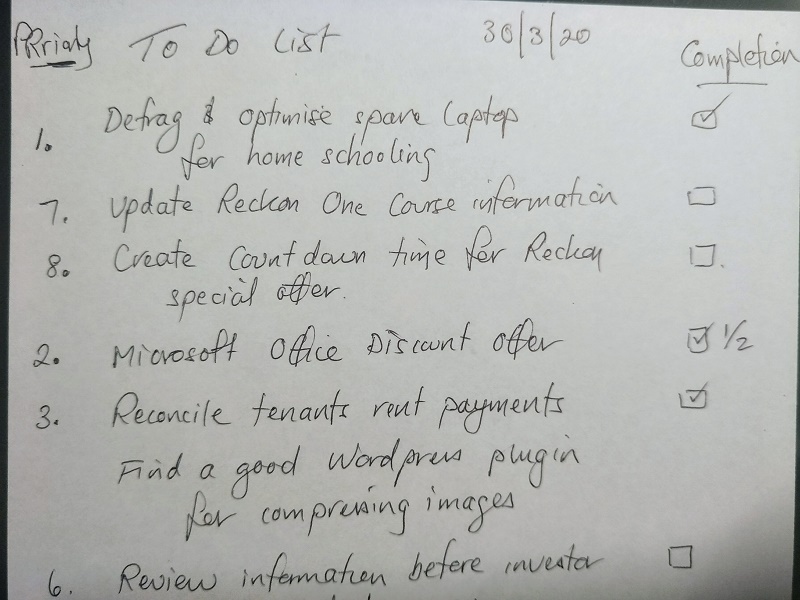

As with all startups they are setting up new processes and experience hiccups along the way like all businesses do.

As with all startups they are setting up new processes and experience hiccups along the way like all businesses do.