Help us help you get your business financials set up right

SO WE’RE INTO THE new Australian financial year. With the start of each financial year comes the chance to right last year’s financial habits and avoid repeating them again. You know what they say about people who repeat the same actions over and over again expecting different results …

If you had a crazy end of financial year, try starting off the next 12 months (well, 11 now, can you believe it!) on a positive footing, with these good financial habits.

Check your accounting software is set up correctly

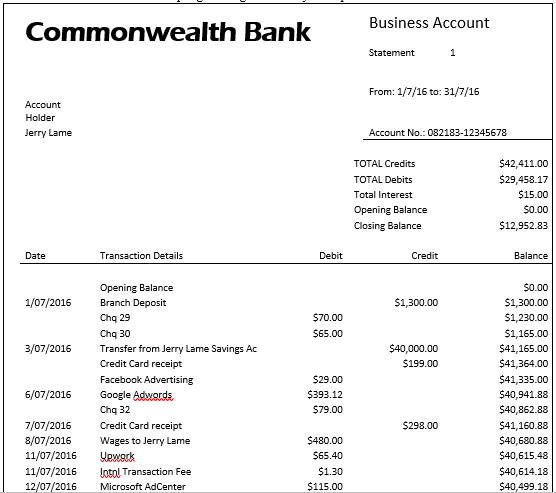

Something that causes businesses and their owners countless headaches at tax time is accounting software that’s been setup incorrectly or not set up completely. Transactions that are coded wrong or bank feeds that are connected to the wrong account — or too few accounts — can leave you in the middle of a bookkeeping nightmare come June 30.

Spend some time sorting this out, or employ a bookkeeper to get you set up correctly. It’s worth that little bit of extra time now to get it right, truly!

Aim for daily reconciliations

Reconciling your business accounts regularly is important for a number of reasons, fostering good habits being chief among them. You may not need to reconcile your accounts each day, but it’s certainly a lot easier to find 10 or 15 minutes two or three times a week, rather than two or three hours once a month. The most often you do your bookkeeper the more unlikely it is that you’ll leave it pile up, eventually requiring costly rescue bookkeeping. You’ll also have a much better picture of your business’s performance with current accounting data.

Monitor cash flow

Positive cash flow is the marker of a healthy business. Negative cash flow is not. There are plenty of seemingly profitable businesses suffering negative cash flow that threatens to put them out of business. Don’t let yours be one of them. Create your own cash flow forecast reports in Excel or use a cash flow forecasting or expense app to determine if you’ll have enough money in the bank to meet your ongoing commitments (which includes paying yourself a living wage to meet your personal commitments).

***

Our cloud accounting training courses will show you how to set up your accounting software correctly. Learn how to use Xero, Quickbooks or MYOB with our online training courses and be able to invoice customers on time, reconcile your account and run financial reports, including cash flow statements. Visit our website for more information.

Xero for less…

Our Xero online training courses include EVERYTHING for ONE LOW PRICE. Furthermore, if you select our Lifetime Membership option, you’ll have LIFETIME access to our ongoing course updates. All EzyLearn courses are accredited by the Institute of Certified Bookkeepers (ICB) and can be counted towards Continuing Professional Development (CPD) points. Find out more about our Xero online training courses.

At EzyLearn we are constantly refreshing the content of our online training courses. Relevant to those of you doing Payroll, might be our

At EzyLearn we are constantly refreshing the content of our online training courses. Relevant to those of you doing Payroll, might be our

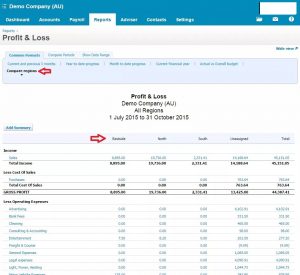

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.