Are EzyLearn students just like YOU?

IF YOU’RE RECEIVING the job alerts everyday — indeed, you may even have applied for some jobs already — but you’re still not getting called up for interview, then the following questions of doubt may be brewing:

MYOB has recently changed their website and in particular their pages for the free trial software.

We’ve updated the FREE MYOB Trial (within our MYOB courses) so look for the link when you access your MYOB courses and use the free trial software to practice what you learn in the video tutorials and training workbooks.

While we’re on the topic of free MYOB software, did you know that we provide free training course samples for most of our online courses?

Continue reading Don’t use the FREE MYOB Training Student Edition

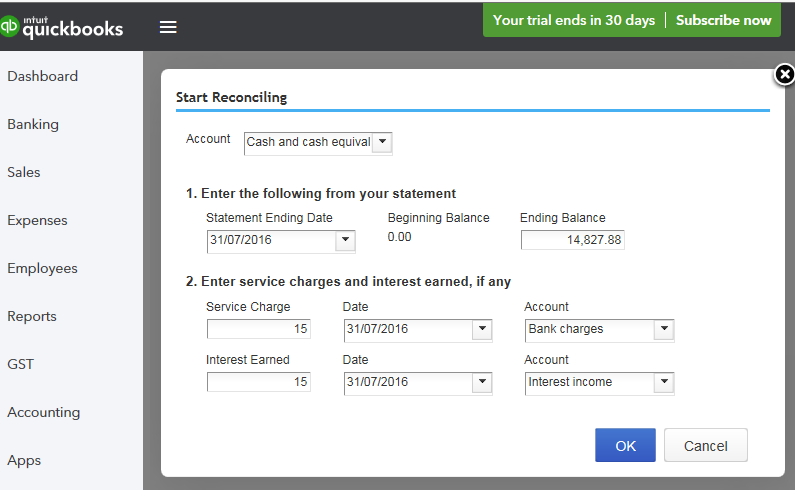

In our educational guide, Bookkeeping Beginner Basics, which you can download from the EzyLearn website for free, you’ll learn how to record journal entries in your accounting software, whether you’re using MYOB, Xero or QuickBooks. Most bookkeeping newbies don’t know what a journal entry is, though, which is what this blog post – the latest in our Bookkeeping Beginner Basics guide companion series – is going to help you to understand.

An accounting journal is the record that keeps accounting transactions in chronological order (i.e., as they occur), while the general ledger is a record that keeps accounting transactions by the account – see our previous post on the chart of accounts [Bookkeeping Beginner Basics: The Chart of Accounts] if you need help understanding what the term ‘account’ means in this context. Before computers, bookkeepers used to log all the financial transactions of a business in paper journals, and then at the end of the month transfer these journal entries into the general ledger, which was divided into various accounts that is now called the chart of accounts, and all the transactions were posted to these accounts using a method called double-entry bookkeeping.

Today, however, accounting systems, such as MYOB, Xero, QuickBooks and the like, will automatically record most business transactions into the ledger immediately after the software prepares sales invoices, issues cheques to creditors, or processes receipts from customers, and as such you don’t have to create journal entries for most of your business’s transactions.

That being said, some journal entries still need to be processed, in order to record transfers between bank accounts and to record adjusting entries. You would need to make a journal entry, for example, at the end of each month to record depreciation or to record interest accrued on a bank loan.

If journal entries and general ledgers and the double entry bookkeeping method sound a bit too much, and you think you’d rather stick to the cash-based accounting method instead, prepare yourself for bad news: all businesses, whether they use the cash-based accounting method or the accrual accounting method, use double-entry bookkeeping to keep their books, and all accounting software applications, by default, are set up to adhere to the double-entry method, too. The double-entry bookkeeping method reduces errors and also ensures that your books balance, so as complicated as it may seem, it’s much easier in the long run.

If you still feel a little out of your depth, however, you can hire a reliable bookkeeper to manage your bookkeeping system and deal with all the journal entries and double-entry business for you, instead. Visit the National Bookkeeping website for to find a highly qualified bookkeeper whose experience and skills suit your business needs.

This blog post is part of our Bookkeeping Basics series, which are being published to complement our new educational guide, also titled Bookkeeping Beginner Basics, which you can download for free from the EzyLearn website.

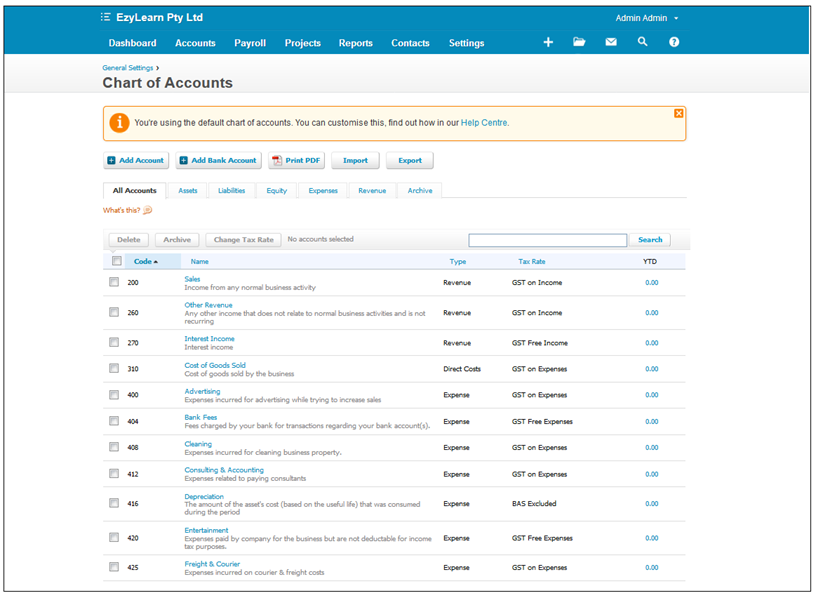

We created a free educational guide, called Introduction to Bookkeeping Beginner Basics, which is available to download from the EzyLearn website, and to complement that guide, we’ve been publishing a series of blog posts, also titled Bookkeeping Basics. We’re now three posts in, and we’re going to be look at the chart of accounts, which is the foundational element of every business’s accounting system. The Bookkeeping Basics guide will take you through how to set up a chart of accounts in your accounting software, whether you’re using Xero, MYOB or QuickBooks, while this blog post is going to explain why it’s important.

The chart of accounts (COA) is an organisational tool that lists every account in a business’s account system. In the context of bookkeeping, ‘account’ is used to refer to a unique record for each type of asset, liability, equity, revenue and expense. So a chart of accounts, then, is just a system that organises your finances so that your reports make more sense and you can easily see the financial health of your business.

A well-designed COA helps the business to comply with financial reporting standards, and should be flexible enough so that a business can tailor its chart of accounts to best suit its needs. Within the categories of operating revenues and operating expenses, for instance, the accounts might be further organised by business function or by company divisions. As such, a COA can be as large and as complex as the business itself.

When you set up your chart of accounts, it will be organised the same way every other company does – your banks accounts come first, then all assets, liabilities, equity, income, and expenses in that order. Here’s what each of those accounts mean:

Your accounts receivables are considered an asset, as is your income, but the two are completely different things. Accounts receivables are business claims against the property of a customer that’s occurred following the sale of goods and/or services, and income is what you have collected from the sale of those goods or services.

In other words, if you invoice a customer and give them time to pay, then that’s ‘accounts receivable’. When you collect the money and deposit it into your account, it’s ‘income’.

Learn about Accounts Receivables tasks in the Daily Data Entry Transactions courses for MYOB, Xero or QuickBooks Online.

Liabilities are notes owed by the business. If you lease anything or you’re buying anything on credit – this includes suppliers who extend a line of credit to you – then it’s considered a liability.

An equity account would be any equipment the company has paid for, or would receive money for if it is sold. Cars, machinery, and certain office equipment are all considered equity. If you had a loan on a business vehicle, the payments you make would be considered a liability, but the vehicle itself would be equity. Each time you make a payment, the liability goes down, while the amount of the equity account would increase. To keep your balance sheet accurate, you need to track both.

Finally, expenses are just that: the money paid by the business for the operation and production of goods and services that are paid for immediately. This includes things like stationery or fuel for a business vehicle, which are paid for at the point of sale, is an expense, where a telephone bill that allows you 14 days to pay, on the other hand, is a liability.

Whether you’re using an old fashioned pencil and paper, an excel spreadsheet, or more sophisticated accounting software, such as MYOB or Xero, it’s important to know where your money is coming from and where it’s going to. A chart of accounts is the organisational tool that allows you to do that. And it’s important to keep it up-to-date, so that, if for any reason, you want a picture of how your business is performing financially, your reports will be accurate.

This blog post is part of our Bookkeeping Basics series, which are being published to complement our new educational guide, also titled Bookkeeping Basics, which you can download for free from the EzyLearn website.

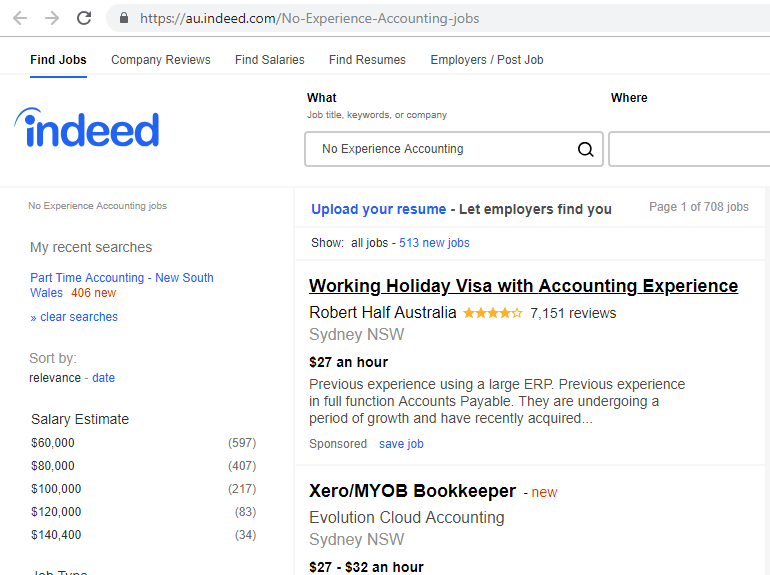

There are plenty of reasons that you have no experience: Changing careers, new graduate or re-entering the workforce after many years away (like when you’ve started a family and been out of the workforce as a parent). These circumstances justify your lack of experience but there are things you can do.

Our team has reviewed the features of some of Australia’s biggest job boards for accounting jobs and we’ve used some of the features that can help job seekers receive notifications when new jobs become available. There is hope and there are things you can do.

Continue reading How to get an accounting job with no experience

To understand value-based pricing take a look at the fees charged for bookkeeping using Xero at National Bookkeeping. These fixed rates are offered to small to medium businesses to give them a clearly defined outcome for a fixed price that they can budget on.

Although the bookkeeping service is offered for a fixed price each week the bookkeeping tasks can include lots of different steps that can be quite time consuming and varied, including:

Continue reading Reduce stress and still earn good money as a bookkeeper

Our team did a little research into job sites for accounting jobs and thought we’d explore a bit about why people like using the major job board in Australia.

The biggest reason is that they are the biggest job board in Australia so most advertisers spend the little bit extra to promote their positions available at the site. But there are some great tools for job seekers to be registered on the site. Continue reading Reasons Why Seek is Number 1 for Accounting Job Search

Xero is complicated, let’s be honest. I know that Xero tell you the software is beautiful and simple to use but in reality it’s accounting software and if accounting software was easy then everyone would have their BAS’s lodged on time and have no credit risk issues.

It also depends on what kind of past experience you’ve had with accounting and bookkeeping work, but there is a way to up-skill in Xero quickly.

If you’re looking for a job it’s a daunting process because you have to sell yourself to an employer and most people don’t have to do this very often. Parents returning from parenting can find it particularly daunting because they’ve found themselves surrounded by nappies, cleaning, cooking and washing and the thought of presenting themselves to other adults can be scary.

I’ve spoken to some EzyLearn students in the last couple weeks about our Accounting Course Tutor Initiative and have been impressed at how capable many of them (you) are!

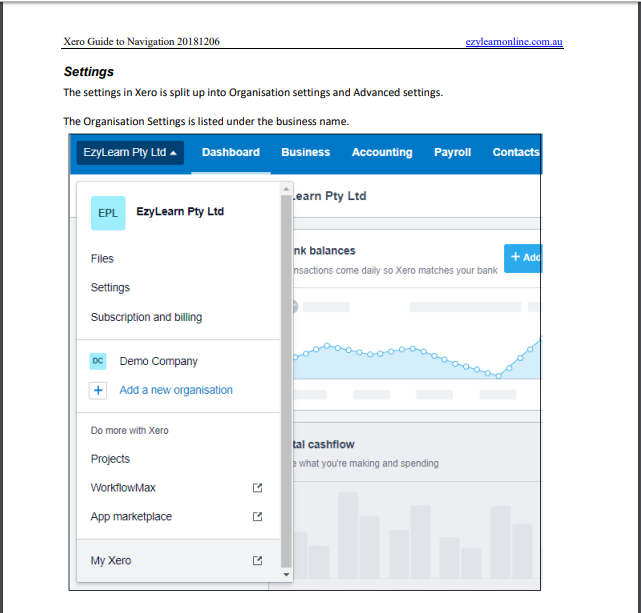

My first thought when a software company changes its navigation (in a significant way) is that there were issues with the previous version.

THIS BLOG POST comes in the wake of Xero promising to improve their navigation in October 2018. Xero has now subsequently released those changes and our online support team are receiving lots of requests for help!

First and foremost, if you’re an EzyLearn student, please note that we’ve already created an update addressing the navigational updates and this is available in all of our online Xero Training Courses.

Continue reading Are You Finding Xero’s New Navigation a Pain in the Proverbial?

THE TRUTH IS, writing a blog post takes time. If it were the case of just writing some sentences, it wouldn’t take that long at all.

But what’s the point of that? The last thing you want to do in a busy, information-saturated world is waste people’s time. It’s an insult and you’ll put them off.

After all, these people have given up time in their busy days to read what you have to say. Don’t ruin this special relationship forever by churning out rushed, poor quality content or waffle.

Always think: What’s in it for them? Continue reading How Long Does it Take to Write a Blog Post?

COULD YOU EARN a second income by running a website? Thousands of Australians already are; if you have bookkeeping or creative skills, perhaps it’s suited to you too.

Most people now know that the old way of working — long hours in an office at a job they don’t really enjoy — is not living their best life. And simply dreaming of a better one simply won’t cut it, but there is a way. Continue reading Are You Living Your Best Life?

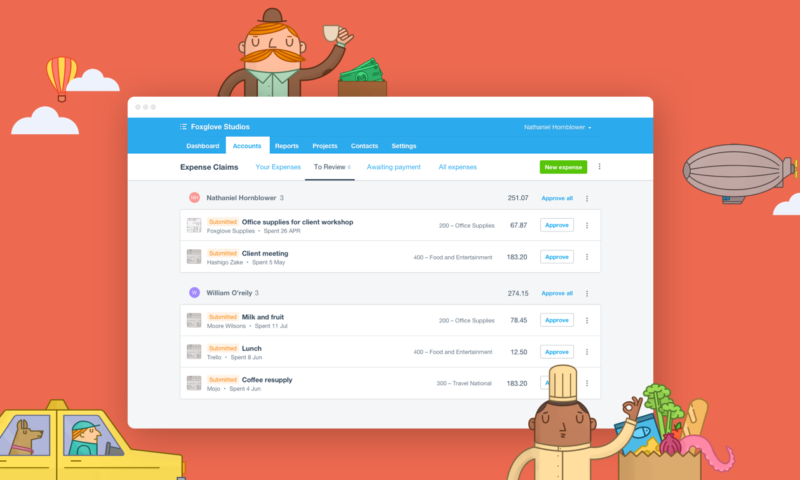

MANAGING EXPENSES AND capturing source documents, like receipts, is the bane of most accounting department managers. But can this now be done with ease?

Before I sold the business for AccessID/EzyAccess Safety Management software, I used the business credit card for all business-related expenses. However, credit card or not, the Financial Controller for our financial team was constantly asking for hardcopy or electronic receipts.

Whether you’re a bookkeeper or business owner, receipt filing (and filing in general) can easily get on top of you. This wouldn’t be so bad if it wasn’t such an important part of running a business.

Some bookkeepers and business owners defer to tradition and print each invoice, bill or other expense and then file the hard copies — but there is a better way. Continue reading Xero Expenses – Most Beautiful Accounting Software of All?

DO YOU GET frustrated when you see the little box at the bottom of the BAS lodgement form? You know, the one where they ask how long it took to complete the form because I feel like writing, “It took 10 minutes to complete the form, but 4 hours to do the data entry and bank reconciliation work!”

Junior bookkeepers, accounts receivable and accounts payable clerks, and office administrators will all share that their most time-consuming work is data entry, coding and bank reconciliations. However, there is software available which almost totally automates this work — and it’s becoming increasingly accurate and speedy.

Continue reading Receipt Scanning, Automatic Coding – Boon for Bookkeepers or Job Killer?

I RECENTLY HAD the pleasure of visiting the Reckon head office in Sydney to learn more about their new Reckon One product — and it’s quite a compelling offer.

To start with, Reckon, a listed company, was not allowed to sell its accounting practice management software (APS) to its competitor, MYOB, because Xero HQ wasn’t much chop.

Yes, that’s right, Xero HQ was deemed so “insufficient and unsophisticated” that it wasn’t viewed by the ACCC as offering any competition in this marketplace whatsoever and therefore they wouldn’t allow MYOB to hold the monopoly.

This made me, and no doubt, many others, realise just how powerful Reckon could be in the online accounting market if it had the right software offer — and now it does.