The key to cutting down discrepancies is consistency

IF YOU RUN A SHOP or business that holds stock, you should be in the habit of checking your inventory regularly. A lot of retail stores only check their inventory every quarter; others every year. This is usually because a stocktake is a big job.

The case for a monthly stocktake

The case for a monthly stocktake

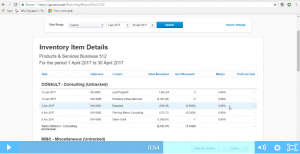

The inventory feature in Xero was a functionality that was missing for many years — but then Xero caught up.

Running an inventory report in Xero is pretty easy. The hard work sets in when you have to count your inventory to account for any discrepancies. There are usually always differences between what Xero says you should have in stock, and what you actually have on hand. The more frequently you run them, the fewer discrepancies you’ll find.

Like anything in the bookkeeping process, the more frequently you do something — be it reconciling your account or chasing up late payers — the easier and quicker it is. Where a quarterly or yearly stocktake could take half a day or more, a monthly one may only take you a couple of hours.

Understand trends in your business

A monthly stocktake is a good way to get to know your business, and understand its certain trends and idiosyncrasies. In particular, it helps you with ordering and making related business decisions.

A shop selling food, for example, needs to be wary of ordering stock that doesn’t sell quickly and ultimately goes out of date. A monthly stocktake will help you keep track of this, and monitor which items sell quickly and which don’t. Likewise, a monthly stocktake of a furniture shop lets you determine which pieces spend long periods in storage, and manage your ordering accordingly.

Run inventory reports in Xero

Do a monthly stocktake by running your inventory reports in Xero. You’ll be able to work out whether your stock:

- is ageing (for technology retailers)

- is going off (food)

- costs more money to store (furniture); and, subsequently, how long it can take to sell before it’s costing you money.

If you are new to bookkeeping it’s probably a good idea to learn more about some of the basic Xero reports you can produce for a business.

***

***

If you only have a very basic knowledge of Xero, cloud accounting or bookkeeping, and you’re looking to gain a better understanding of basic bookkeeping terminology, get our free Basic Bookkeeping Guide.

You’ll learn how to run reports in Xero, in particular inventory reports, in our Xero training courses. Visit our website for more information or to enrol and see course prices.

EzyLearn Excel, MYOB and Xero online training courses count towards Continuing Professional Development (CPD) for bookkeepers and accountants. We’ve been an accredited training provider of the Institute of Certified Bookkeepers ever since the organisation started in Australia. Find out how CPD points can be of benefit to you.